Introduction

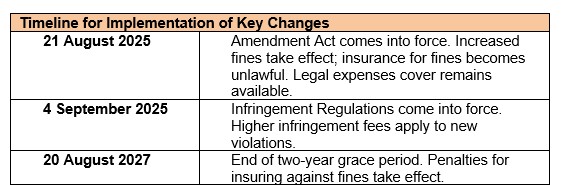

The resource management landscape in New Zealand has undergone a seismic shift with the recent passage of the Resource Management (Consenting and Other System Changes) Amendment Act 2025, which received Royal Assent on August 20, 2025. This amends the Resource Management Act 1991 (the RMA).

Prohibition on Insurance for Fines and Penalties

Similarly to the Health and Safety at Work Act 2015, the Amendment Act explicitly makes it unlawful to insure against infringement fees or fines under the RMA. Any existing statutory liability insurance policy provisions that purport to cover RMA fines will be rendered void and ineffective. This prohibition extends not only to purchasing insurance coverage but also to any attempts to indemnify or make payments to cover another person’s liability for RMA fines or infringement fees.

Legal expenses cover is available

Insurance remains available for legal and expert costs incurred during prosecutions, as well as for remediation costs ordered by the Court. Experience from the health and safety sector, which has similar prohibitions on insurance for fines, suggests that this type of coverage remains valuable for managing the substantial costs associated with defending against environmental prosecutions.

Hesketh Henry’s resource management team provides such support and works with a range of environmental experts who can assist in defending prosecutions.

Dramatic Increase in Penalties for Environmental Offenses

The Amendment Act imposes unprecedented increases in the maximum fines for environmental offences, elevating RMA violations to among the most severely penalised offences in New Zealand, in financial terms. For individual offenders, the maximum fines have skyrocketed from $300,000 to $1 million, while for corporations, the maximum penalties have surged from $600,000 to a staggering $10 million. In a contrasting move, the maximum term of imprisonment for individuals has been reduced from two years to 18 months, meaning all prosecutions will be handled by a judge alone without the option for jury trial.

These dramatically increased penalties are expected to have a profound deterrent effect on environmental offending. While actual fines imposed tend to be well below the maximum amounts in practice, the new maximums will inevitably result in a proportionate escalation in sentencing outcomes over time. The Sentencing Act 2002 provides that offences committed prior to the effective date of 20 August 2025, will benefit from the previous penalty structure, which is particularly relevant for ongoing environmental investigations and cases where defendants are awaiting sentencing.

Grace Period and Penalties for Violations

The legislation provides a two-year grace period for prosecution of the insurance prohibition. After this period, significant penalties will apply to anyone who enters into prohibited insurance arrangements or attempts to indemnify others against RMA fines. Individuals face fines of up to $50,000 for violations, while other entities can be penalised up to $250,000. This grace period offers businesses and insurers time to adjust their policies and practices to align with the new legal requirements.

Increased Infringement Fees and Separate Regimes

Complementing the increased fines for more serious offences, the Resource Management (Infringement Offences) Amendment Regulations 2025 introduce higher infringement fees for lesser contraventions of the RMA. These regulations, which come into force on 4 September 2025, create separate infringement regimes for individuals and companies. The previous infringement fees, which ranged between $300 and $1,000 for various contraventions, have been increased to between $600 and $2,000 for individuals and $1,200 to $4,000 for companies.

Strategic Implications of Infringement Changes

This differentiation between individual and corporate infringement fees acknowledges the different types of offenders and their varying capacities to pay, while simultaneously increasing the deterrent effect across all levels of offending. The increased infringement fees, combined with the prohibition on insurance coverage, mean that even minor violations will now carry more significant financial consequences that must be borne directly by the offender rather than passed on to insurers.

Disclaimer: The information contained in this article is current at the date of publishing and is of a general nature. It should be used as a guide only and not as a substitute for obtaining legal advice. Specific legal advice should be sought where required.